COLUMN

Column

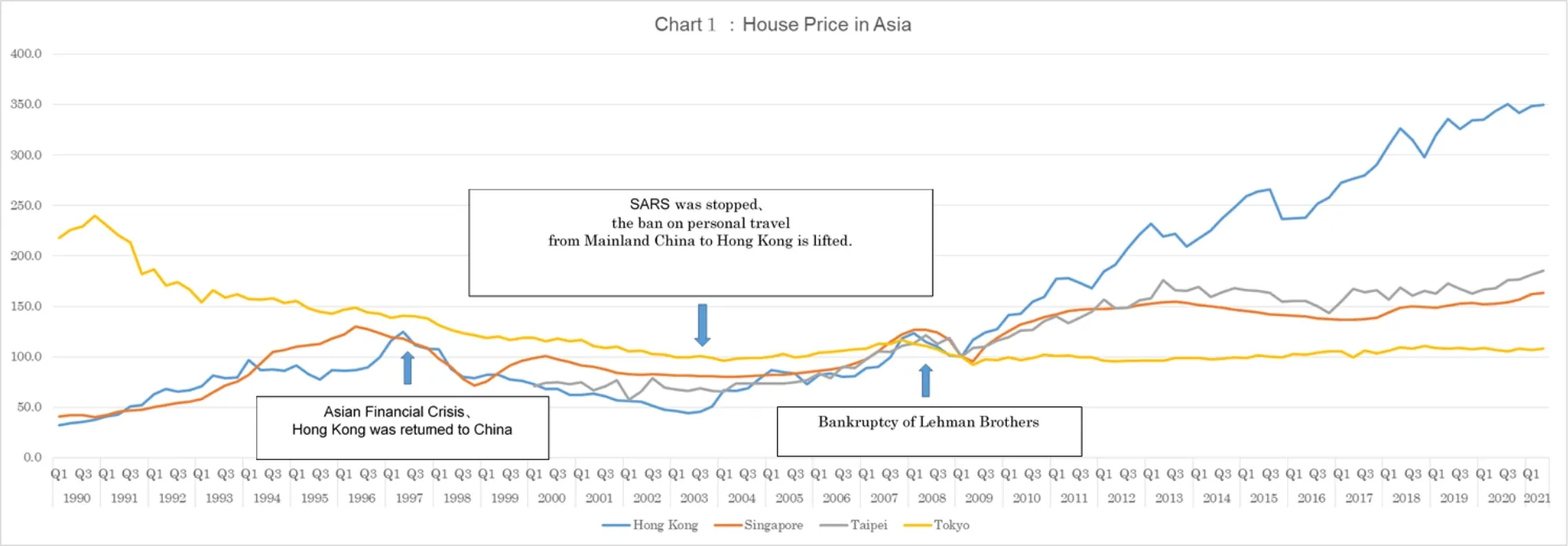

Asian Housing Price

Notes for Chart1(Click to enlarge)

2009=100.

Information Source:Data.gov.sg(Government of Singapore), The Government of the Hong Kong Special Administrative Region, Ministry of the Interior(Taipei), Ministry of Land and Infrastructure and Transport,

Tokyo Association of Real Estate Appraisers. Data is compiled by us.

Although our company attempts to provide accurate information on this Website, we assume no responsibility for the accuracy of the information.

Our company cannot completely guarantee the accuracy of the posted content or the security of the website. There is no guarantee for the prospect.

Our company may change and/or alter the contents of the Web Site or may suspend or discontinue the services provided through the Web Site at any time without any prior notice.

Our company is not liable for any trouble, loss, or damage arising from any acts performed as a result of decisions made based on the information contained on this website.

Real Estate prices are regarded as cheaper in Tokyo recently.

After the termination of Japanese asset inflated economy, i.e. the collapse of the bubble, in 1990s, the Japanese real estate price has a tendency to come down. Especially, at the bankruptcy of Lehman Brothers in 2008, it went down drastically.

After that it showed some recovery. But the price increase is limited.

At the Asian financial crisis and the return of Hong Kong to China, the real estate market in Hong Kong and Singapore showed the fall of prices. After that it is notable that the Singapore market shows rapid recovery, i.e. V-shaped turnaround.

At the Hong Kong real estate market, the prices went down until 2003. However, SARS stopped and the ban on the personal travel from Mainland China to Hong Kong was lifted. The prices went up.

The bankruptcy of Lehman Brothers in 2008 influenced the market in Hong Kong, Singapore, Taipei equally, and real estate prices of these market at that time went down notably. However, after that, the prices of Hong Kong market shows the strong recovery by far. At first, the prices of the market in Singapore and Taipei went up in line with the prices of the market in Hong Kong. After 2011, they could not catch up with the price increase in Hong Kong market.

Generally, after 1990s, the prices in the Japanese real estate market are coming down on a long – term basis, and the market continues to decline. On the other hand, the market in Asian countries, especially, the market in Hong Kong, shows price increase steadily. This report is as of 2021 Q2. After that, collapse of Chinese real estate market bubble is reported. We should be careful of the impact for Asian countries.