COLUMN

Column

2023 January Vol.1

Newsletter

How commercial area land value will be against the future interest rate hike?

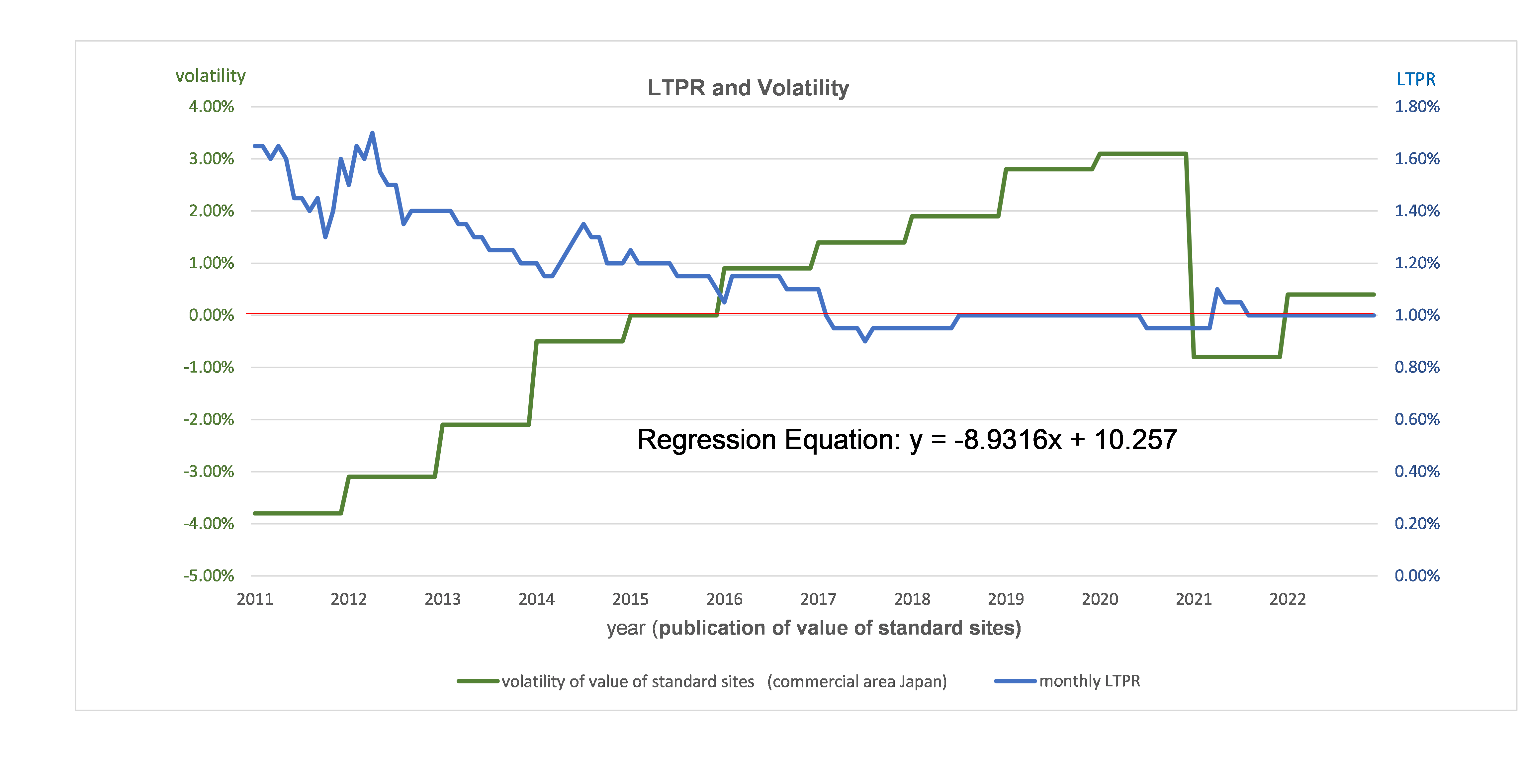

Recently, long term interest rate maintains underlying upward trend. As of January 11th this year, Long Term Prime Rate (LTPR) is raised to 1.40%, which is a 11-year high. In order to understand how interest rate change influences land value, now, our company analyzed the relationship between monthly LTPR since 2010 and volatility of value of standard site. It will be highly appreciated if it is helpful to see the land value trend and to have a guideline for your real estate investment.

(Remarks) LTPR is that of one year before the publication of value of standard sites in order that we can capture the interest rate influence for the next one year volatility of land value.

In general, it is said that there is negative correlation between interest rate and land value. Above mentioned regression equation’s correlation coefficients is at (–) 0.85. It is clear that there is a rather stronger negative correlation between LTPR and volatility of land value. As long as we capture the volatility of land value against the latest interest rate through above mentioned regression equation, for the current LTPR at 1.40%, the volatility of the land value is (–) 2.25%. The long term interest rate will go up from now on, and land value in commercial area is expected to go down. In the above, our analysis is mainly by the interest rate change. However, land value is not decided only by financial factors. Various factors such as the characteristics of the area and site specific value factor etc. also influence it. It is requested to create a new value by materializing the highest and best use of the environment and land where the property is located hereafter.

Contact us: Japan Appraisal System Inc. Tokyo Head Office Real Estate Consulting: Okajima